onehead.online

Community

Dogecoins Graph

Find the latest Dogecoin USD (DOGE-USD) stock quote, history, news and other vital information to help you with your stock trading and investing. View live Dogecoin price chart and follow real-time Dogecoin price changes. The current price of Dogecoin (DOGE) is USD — it has risen % in the past 24 hours. Try placing this info into the context by checking out what coins. The price of Dogecoin is $ Buy Dogecoin - DOGE with $1. Invest in DOGE cryptocurrency with Robinhood in the easiest and fastest way. Dogecoin chart for price, market cap, DOGE supply and volume. Check out our Dogecoin charts and get the latest and historical information about Dogecoin. Dogecoin (DOGE) Stats. Transactions count, value, Dogecoins sent (Dogecoin price history charts), 1 DOGE = USD ( ). The price of Dogecoin has decreased by % in the last hour and increased by % in the past 24 hours. Dogecoin's price has also fallen by % in the past. (%). Summary · News · Chart · Community · Historical Data · Profile. CCC - CoinMarketCap • USD. Dogecoin USD (DOGE-USD). Follow. +. Track current Dogecoin prices in real-time with historical DOGE USD charts, liquidity, and volume. Get top exchanges, markets, and more. Find the latest Dogecoin USD (DOGE-USD) stock quote, history, news and other vital information to help you with your stock trading and investing. View live Dogecoin price chart and follow real-time Dogecoin price changes. The current price of Dogecoin (DOGE) is USD — it has risen % in the past 24 hours. Try placing this info into the context by checking out what coins. The price of Dogecoin is $ Buy Dogecoin - DOGE with $1. Invest in DOGE cryptocurrency with Robinhood in the easiest and fastest way. Dogecoin chart for price, market cap, DOGE supply and volume. Check out our Dogecoin charts and get the latest and historical information about Dogecoin. Dogecoin (DOGE) Stats. Transactions count, value, Dogecoins sent (Dogecoin price history charts), 1 DOGE = USD ( ). The price of Dogecoin has decreased by % in the last hour and increased by % in the past 24 hours. Dogecoin's price has also fallen by % in the past. (%). Summary · News · Chart · Community · Historical Data · Profile. CCC - CoinMarketCap • USD. Dogecoin USD (DOGE-USD). Follow. +. Track current Dogecoin prices in real-time with historical DOGE USD charts, liquidity, and volume. Get top exchanges, markets, and more.

Charts. Real Time Charts. Live Charts · Currency Chart · Futures Chart · Stocks Chart · Indices Chart · Cryptocurrency Chart · Interactive Currency Chart. View Dogecoin (DOGE) cryptocurrency prices and market charts. Stay informed on how much Dogecoin is worth and evaluate current and historical price. Dive into Dogecoin market data, including price fluctuations, market cap shifts, and trading volumes. View live Dogecoin price chart and follow real-time Dogecoin price changes. Dogecoin (DOGE) price has increased today. The price of Dogecoin (DOGE) is $ today with a hour trading volume of $,, Actionable trading signals and analytics for Dogecoin (DOGE) based on price, blockchain, social media, and crypto exchange data. The current Dogecoin hashrate (DOGE hashrate) is PH/s at block height 5,, with a difficulty of 31,, Dogecoin Hashrate Stats. Current. In the past 24 hours, the price of DogeCoin has decreased by %. It's price has risen by % in the last 7 days. The current price per DOGE is $ AUD. Current Dogecoin to USD price charts. View graphs, market depth, historical pricing data & buy/sell bids on one Australia's largest Dogecoin exchanges. Dogecoin - USD crypto price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Dogecoin (DOGE) prices - Nasdaq offers cryptocurrency prices & market activity data for US and global markets. Dogecoin's price today is US$, with a hour trading volume of $ M. DOGE is +% in the last 24 hours. It is currently % from its 7-day all. Dogecoin Price Summaries. Latest Data. Dogecoin's price today is US$, with a hour trading volume of $ M. DOGE is +% in the last 24 hours. It. In depth view into Dogecoin Price including historical data from to , charts and stats Level Chart. View Full Chart. 1m; 3m; 6m; YTD; 1y; 3y; 5y; 10y. Track Dogecoin price today, explore live DOGE price chart, Dogecoin market cap, and learn more about Dogecoin cryptocurrency. Being closely associated with Bitcoin and Litecoin, the DOGE price chart often mirrors their performance. The surge in Dogecoin's popularity, especially over. The current price of Dogecoin / TetherUS (DOGE) is USDT — it has fallen −% in the past 24 hours. Try placing this info into the context by checking. Dive into Dogecoin market data, including price fluctuations, market cap shifts, and trading volumes. Get the latest price, news, live charts, and market trends about Dogecoin. The current price of Dogecoin in United States is $ per (DOGE / USD). Dogecoin (DOGE) price per day from December 4, to August 29, (in U.S. cents) [Graph]. In Statista. Retrieved August 30, , from https://www.

Best Maternity Bras And Underwear

Collection: Nursing & Pumping Bras & Tanks · Undercover Reversible Sleep Nursing Bra · SuperMom™ Fixed Padding Nursing And Pumping T-Shirt Bra | Black · SuperMom™. Premium Maternity Bras by Natori · How to Choose the Right Size Maternity Bra · Transitioning to Postpartum with Versatile Nursing Bras. Stay comfortable and confident throughout your pregnancy journey with our Maternity Underwear! Featuring leak-proof nursing bras, belly briefs, and more. >> Why wear maternity and nursing bras? · Peekaboo - Classic Nursing Bra + Hands Free · Baesic Bra - Breastfeeding Lingerie · Yummy Mummy - Sporty Maternity Bra +. Best Rated and Reviewed in Nursing Bras() · Momcozy Nursing Bras for Breastfeeding, YN46 Jelly Strip Support Comfort Maternity Bra · Joyspun Women's Maternity. Best Selling Bras · New Bras · Bra Packs · Skin Tones · Maternity & Nursing · Bras on Bra & Panty Sets · Gifts. By Style; Shop All Lingerie · Babydolls, Slips. They're designed to look good instead of feel great. A great nursing bra should do all of the above and more. ThirdLove's maternity bras are designed with your. Maternity Underwear · Everyday Underwear · Apparel · Maternity & Nursing This website uses cookies to ensure you get the best experience on our website. 29 products · The Everything Bra: 3-Pack. Bundle & Save 10% · The Do Anything Bra. 10% off · The Effortless Bra · The Effortless Bra · Always-On Nursing Tank: Collection: Nursing & Pumping Bras & Tanks · Undercover Reversible Sleep Nursing Bra · SuperMom™ Fixed Padding Nursing And Pumping T-Shirt Bra | Black · SuperMom™. Premium Maternity Bras by Natori · How to Choose the Right Size Maternity Bra · Transitioning to Postpartum with Versatile Nursing Bras. Stay comfortable and confident throughout your pregnancy journey with our Maternity Underwear! Featuring leak-proof nursing bras, belly briefs, and more. >> Why wear maternity and nursing bras? · Peekaboo - Classic Nursing Bra + Hands Free · Baesic Bra - Breastfeeding Lingerie · Yummy Mummy - Sporty Maternity Bra +. Best Rated and Reviewed in Nursing Bras() · Momcozy Nursing Bras for Breastfeeding, YN46 Jelly Strip Support Comfort Maternity Bra · Joyspun Women's Maternity. Best Selling Bras · New Bras · Bra Packs · Skin Tones · Maternity & Nursing · Bras on Bra & Panty Sets · Gifts. By Style; Shop All Lingerie · Babydolls, Slips. They're designed to look good instead of feel great. A great nursing bra should do all of the above and more. ThirdLove's maternity bras are designed with your. Maternity Underwear · Everyday Underwear · Apparel · Maternity & Nursing This website uses cookies to ensure you get the best experience on our website. 29 products · The Everything Bra: 3-Pack. Bundle & Save 10% · The Do Anything Bra. 10% off · The Effortless Bra · The Effortless Bra · Always-On Nursing Tank:

Our nursing bras are perfect for busy moms who want a functional yet stylish solution. Shop the best nursing bras Panty Styles · Size Charts · Bra. Shop Target for bra maternity underwear you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup plus free shipping on. Wireless Maternity Bra · Made with comfort-first details to accommodate changes in breast size from pregnancy to postpartum · Features a drop-down overlay fabric. Nursing Bras & Maternity-to-Nursing Clothing · % Organic, Undyed Cotton Nursing Bra · Sporty & Size-Inclusive Nursing Bras · Best Variety of Styles (Including. Comfortable, quality, luxury intimates for maternity. Browse our nursing bras here and earn free shipping on orders over $ Super easy returns! Black Wireless and seamless push up Bralette and panty set. Best Bralette for daily wear, sport, yoga. Maternity and Nursing Friendly Bra · Maternity Nursing Bra - Almond Nude · Maternity Nursing Bra - Architect · Maternity Nursing Bra - Onyx · Maternity Nursing Bra. Invest in comfort and fit with Gap maternity bra & underwear options, plus a variety of nursing bra options. Find maternity bras & undies for total comfort. We understand the needs of pregnant and breastfeeding women. This is why we stock only the best maternity bras online and in our store. Some of the popular. Shop for Nursing Bras & Maternity Panties in Nursing Bras & Maternity Panties. Buy products such as Joyspun Women's Maternity Wrap Front Nursing Bra. Experience postpartum comfort and support with our thoughtfully designed collection of nursing and maternity bras, available in cup sizes ranging from B to DDD. Comfy maternity briefs, maternity bras, maternity tights and compression socks ❤︎ Ultimate comfort ❤︎ Sustainable materials. Panty Guide · Shop Now. MODERN Every mother with a baby at home needs the best nursing bras possible, which is our main goal. Nursing made easy with our Anita maternity bras ; Pregnancy & Breastfeeding - MISS COTTON - Underwire Nursing Bra - pearl white · MISS COTTON -. The band is stretchy, wide and supportive and doesn't This was the first bra I ordered from Cake - while in labour! - and I love it. I absolutely wore it. Shop maternity bras, lingerie & postpartum shapewear, expertly designed for pregnancy, nursing & beyond. maternity bras ; All-Day Nursing Bralette. $ $38 · (5) ; No-Wire Nursing Bra. $ $48 · (66) ; Mesh Trim Nursing Bralette. $ $38 · (70). Hotmilk Nursing Lingerie's best-selling collection combines elegance with functionality, offering new mothers both comfort and style. Featuring luxuriously soft. Bendon Nurture Maternity Bras are designed to support new and expectant mums with comfortable construction and easy fit. pregnant woman in nude color bra and underwear. blue bra Pregnant woman.

Typical Home Insurance Cost Florida

The fact of the matter is that Florida's average cost of homeowners insurance — at $2, per year for a $, house, $4, for a $, house and $5, The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. Average premium is a year, but down here with the cost of insurance and the high deductibles, it almost makes sense just to self insure if able. MoneyGeek reports that the average cost of homeowners insurance in Florida is $2, a year for $K in dwelling coverage, which is 18% less than the national. $ – Florida; $ – Louisiana; $ – Oklahoma; $ – Texas; $ – Rhode Island; $ – Colorado. Over a year period. We offer personalized and affordable home insurance policies with the experience of a large company and the customer-focused attitude of a small company. The national average cost of homeowners insurance is $2, per year for $, in dwelling coverage, but this cost will likely differ depending on which. The average premium for home insurance coverage in Florida is $2, per year1, according to a report (the most recent data available) by the National. Property insurance: 10 highest priced Florida counties · Monroe County: $7, (single-family homes) · Miami-Dade County: $5, · Palm Beach County: $5, The fact of the matter is that Florida's average cost of homeowners insurance — at $2, per year for a $, house, $4, for a $, house and $5, The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. Average premium is a year, but down here with the cost of insurance and the high deductibles, it almost makes sense just to self insure if able. MoneyGeek reports that the average cost of homeowners insurance in Florida is $2, a year for $K in dwelling coverage, which is 18% less than the national. $ – Florida; $ – Louisiana; $ – Oklahoma; $ – Texas; $ – Rhode Island; $ – Colorado. Over a year period. We offer personalized and affordable home insurance policies with the experience of a large company and the customer-focused attitude of a small company. The national average cost of homeowners insurance is $2, per year for $, in dwelling coverage, but this cost will likely differ depending on which. The average premium for home insurance coverage in Florida is $2, per year1, according to a report (the most recent data available) by the National. Property insurance: 10 highest priced Florida counties · Monroe County: $7, (single-family homes) · Miami-Dade County: $5, · Palm Beach County: $5,

insurance quote. ZIP CodeEnter 5 digits _____. Start a quote. Items needed for State Farm Florida Insurance Company Winter Haven, FL. State Farm Lloyds. Save on homeowners insurance in Florida without sacrificing hurricane wind or flood coverage. Learn more about home insurance, or get a quote with Kin. What is the average cost of homeowners insurance in Florida? Florida's average home insurance premium is $2, per year, almost twice the national average of. How much does homeowners insurance cost? The amount you pay The typical homeowners or rental property insurance policy doesn't include flood coverage. The national average homeowners insurance cost is $ and has been steadily increasing each year. ✓ Get details and learn how to keep costs down! Moreover, Florida had the highest average premium nationwide in , at $3, — % more expensive than the $1, U.S. average, Friedlander said. There. Average homeowners insurance cost by state · Florida: $10, · Louisiana: $6, · Oklahoma: $5, · Colorado: $4, · Texas: $4, · Mississippi: $4, · Alabama. The most recent data published by the Insurance Information Institute puts the average cost of homeowners insurance in Florida at $2, per year. That makes. Typically, an HO-3 policy will cover the home's structure, as well as Rather than replacement cost coverage included in HO-5, older home policies. Note: Average premium=Premiums/exposure per house years. A house year is equal to days of insured coverage for a single dwelling. The NAIC does not rank. The cost of homeowners insurance in Florida can vary significantly based on several factors in addition to geographic location: Type of construction; Dwelling. Average FL HO insurance is $ and is going up. Most expensive state for HO insurance in the US. This is a great article w a ton of. How much is homeowners insurance in Florida? Progressive homeowners policies in Florida had an average monthly price of $ or $ for an annual policy. Now's the time to get a home insurance quote. Home. It's your safe haven A typical policy can cover the structure of your home and other structures. The average premium for home insurance coverage in Florida is $2, per year1, according to a report (the most recent data available) by the National. Here, you can see a collection of average annual rates for $, in dwelling coverage from Florida insurers. Insurance Company. △▽. Average Annual Premium. The following is an overview of coverages typically found in homeowners' policies. However, insurance policies vary among insurers. So please take time to. However, the average homeowners insurance in Naples is comparable to the entire state of Florida. Your home insurance cost will range from $1, to $4, a. Average cost of homeowners insurance by state ; Florida, $1, ; Georgia, $1, ; Hawaii, $ ; Idaho, $ Average homeowners insurance cost by state · Florida: $10, · Louisiana: $6, · Oklahoma: $5, · Colorado: $4, · Texas: $4, · Mississippi: $4, · Alabama.

Transunion Credit Unfreeze Phone Number

Fraud Alert vs. Credit Freeze. A fraud alert and a credit freeze are both great, free ways to help you prevent identity theft and protect your personal data. TransUnion LLC. P.O. Box Chester, PA Phone. The following information will be needed: a. Social Security number b. Date of birth c. How to unfreeze credit with TransUnion. To unfreeze your TransUnion credit file, visit the online TransUnion credit freeze management page or call onehead.onlinene DirectoryState AgenciesOnline Services Translate. Search A copy of a government-issued ID card. TransUnion Minor Credit Freeze (Sample). TransUnion offers an easy online form that will help you obtain a credit freeze. The form requires the following: ○ Full name ○ Social Security number. TransUnion Security Freeze. P.O. Box Chester Instructions for placing a security freeze via credit bureau websites or toll-free telephone number. You can also manage your freeze by phone: call us at () You'll be required to give certain information to verify your identity. You'll also have. Technician's Assistant: Is there a phone number or second email address linked to this account? Customer: it may be but i only use the main one. Technician's. Equifax · Experian · TransUnion. You can submit your request online, by phone, or by mail. How long do freeze requests take? Fraud Alert vs. Credit Freeze. A fraud alert and a credit freeze are both great, free ways to help you prevent identity theft and protect your personal data. TransUnion LLC. P.O. Box Chester, PA Phone. The following information will be needed: a. Social Security number b. Date of birth c. How to unfreeze credit with TransUnion. To unfreeze your TransUnion credit file, visit the online TransUnion credit freeze management page or call onehead.onlinene DirectoryState AgenciesOnline Services Translate. Search A copy of a government-issued ID card. TransUnion Minor Credit Freeze (Sample). TransUnion offers an easy online form that will help you obtain a credit freeze. The form requires the following: ○ Full name ○ Social Security number. TransUnion Security Freeze. P.O. Box Chester Instructions for placing a security freeze via credit bureau websites or toll-free telephone number. You can also manage your freeze by phone: call us at () You'll be required to give certain information to verify your identity. You'll also have. Technician's Assistant: Is there a phone number or second email address linked to this account? Customer: it may be but i only use the main one. Technician's. Equifax · Experian · TransUnion. You can submit your request online, by phone, or by mail. How long do freeze requests take?

TRANSUNION: onehead.online or call toll-free EQUIFAX: onehead.online or. To place, temporarily lift or permanently remove a security freeze on your Experian or TransUnion credit reports, please contact them directly. Experian: https. HOW TO UNFREEZE YOUR CREDIT At Dorian Ford Clinton Township, MI ; Experian. Contact Experian by Phone: ; PIN (or) Security Questions ; Transunion. TransUnion or Or write to: Equifax Security Freeze P.O. Box Atlanta, GA ; Experian Security Freeze P.O. Box Allen. Reach us by phone ; Credit Monitoring. TransUnion Credit Monitoring Dashboard · ; Service Center. TransUnion Service Center Dashboard · Place a credit freeze: Experian P.O. Box Allen, TX onehead.online TransUnion P.O. Box Chester, PA transunion. Over the telephone: call ; In writing: Click Here. Here are some simple ways you can help reduce your chances of becoming a fraud victim. **Consumer relations support: If you're a consumer with questions or issues related to your personal credit report, drivers history report, disputes, fraud. For instructions on requesting a credit freeze, you may call the credit bureaus toll-free as follows: Equifax: () ; TransUnion: () ;. For fraud alerts, contact TransUnion at from 8 a.m. to 11 p.m. Eastern time or send mail to the address below. TransUnion Fraud Victim Assistance. Unfreeze credit through TransUnion · Online: Create a TransUnion account online, Opens overlay or by using the myTransUnion® app. · By phone: Call credit freeze right now" and gives me the phone number to their customer service line. Same thing happens when I check if I have a fraud. A credit freeze prevents lenders from checking your credit in order to open a new account. Think of it as having a padlock on your credit report. Remember, if. Contact the Credit Bureaus to Request a Security Freeze · Equifax PO Box Atlanta, GA · Experian PO Box Allen, TX Call You'll need a copy of your most recent Experian credit report and the number digit on it. Transunion. Phone. TransUnion LLC. P.O. Box Chester, PA Phone. The following information will be needed: a. Social Security number b. Date of birth c. How to request a TransUnion credit freeze · Online: Sign up online to freeze and unfreeze your TransUnion credit report. · By phone: · By mail. You can do this online or by mail or by phone with all three credit bureaus: Experian and Transunion, and Equifax. number for any future credit freeze. Transunion · Phone: if you wish to temporarily lift your Security Freeze via telephone. · Mail: Complete the Lift section of the Security Freeze Form. A credit freeze prevents lenders from checking your credit in order to open a new account. Think of it as having a padlock on your credit report. Remember, if.

What Happens When You Dont File Taxes

The sooner you file, the less you'll owe in penalties. If you owe, the failure to file penalty is typically 5% of your unpaid tax. And, the failure to pay. Did you Receive a School District Income Tax Failure to File Notice? Learn If you don't pay enough, you might owe the interest penalty. The penalty for failing to file a tax return is 5% of the unpaid tax per month, plus interest, with a maximum penalty of 25% of the unpaid tax. This penalty applies when you don't file your tax return by the due date. The taxpayer's tax balance will thus be assessed a late filing penalty. It's 5% of the. What Happens If I Don't File Taxes? · You can incur failure-to-file penalties. · Interest will be assessed on your balance. · You may face liens, levies. The most serious penalty is the failure-to-file penalty, which can be as high as 25% of your unpaid taxes. This penalty applies if you fail to file even one tax. The more likely outcome would be the IRS charges you with a failure to file and failure to pay, which carries a penalty of 5% based on the time from the. At its most extreme, your failure to file penalty can total 25 percent of your unpaid taxes. What Happens If You Don't Pay Taxes You Owe? The answer really. If you don't file, you'll face a failure-to-file penalty. The penalty is 5 percent of your unpaid taxes for each month your tax return is late. The sooner you file, the less you'll owe in penalties. If you owe, the failure to file penalty is typically 5% of your unpaid tax. And, the failure to pay. Did you Receive a School District Income Tax Failure to File Notice? Learn If you don't pay enough, you might owe the interest penalty. The penalty for failing to file a tax return is 5% of the unpaid tax per month, plus interest, with a maximum penalty of 25% of the unpaid tax. This penalty applies when you don't file your tax return by the due date. The taxpayer's tax balance will thus be assessed a late filing penalty. It's 5% of the. What Happens If I Don't File Taxes? · You can incur failure-to-file penalties. · Interest will be assessed on your balance. · You may face liens, levies. The most serious penalty is the failure-to-file penalty, which can be as high as 25% of your unpaid taxes. This penalty applies if you fail to file even one tax. The more likely outcome would be the IRS charges you with a failure to file and failure to pay, which carries a penalty of 5% based on the time from the. At its most extreme, your failure to file penalty can total 25 percent of your unpaid taxes. What Happens If You Don't Pay Taxes You Owe? The answer really. If you don't file, you'll face a failure-to-file penalty. The penalty is 5 percent of your unpaid taxes for each month your tax return is late.

If you don't file your taxes or request an extension, the penalties will be up to 25% of what you owe. If you miss the tax-filing deadline and owe taxes, you may be on the hook for penalties and interest on any unpaid balance. If you don't file your taxes on. Are married and file a separate tax return, you probably will pay taxes on your benefits. If you don't have an account, you can create one at onehead.online If you fail to file timely, your account will be forwarded to the Division of Collections. An estimate of the amount due may be billed. If you don't pay the interest and penalties resulting from not filing, and you eventually DO file a tax return, any refund that you get will be. If a return is filed after the due date, a late filing penalty is charged. The penalty is $25 or 10% of the tax due, whichever is greater. If a return is not filed. If the government owes you, you'll lose your refund if you don't file within 3 years of the tax filing deadline onehead.online means that for tax year If you made a mistake on your tax return, you need to correct it with the IRS. To correct the error, you would need to file an amended return with the IRS. The IRS won't file criminal charges against taxpayers just because they don't have the money to pay. This is a fact. So, when you file your taxes late, the. Not filing taxes means you could owe penalties and interest fees on top of your unpaid tax bill. If you don't file, you can lose your refund. If you owe tax, the IRS adds penalties and interest. You may also face liens, levies, and other financial. What happens if you don't file taxes for your business? · Fines and interest · Loss of deductions and credits · General tax liens · Substitute for Return (SFR). If you owe the IRS money, filing your tax return late (or never) can cost you penalties and interest. The answer is yes. You won't receive a tax refund if you don't file taxes. Even worse, you can lose your chance to get a refund. “Not filing a tax return can create a penalty of 5% per month, up to 25%. This is based on the tax due,” Armstrong says. “The penalty for not paying or paying. If you do not file your return, pay your tax on time, fail to provide or quarter-monthly tax payments and failed to do so, or if you failed to pay. If you do not file your outstanding tax return and documents after paying the composition amount, legal actions may still be taken against you. The payment made. You will be fined, your wages and other assets may be seized. You could be convicted of income tax evasion and jailed just like many gangsters. If you don't file, you'll face a failure-to-file penalty. The penalty is 5 percent of your unpaid taxes for each month your tax return is late.

Where To Buy A Tesla

It's a horrible idea to buy any vehicle from Carmax. That place is trash and scammers. Good luck getting your title and running around for. When you buy used cars from Enterprise Car Sales, you get our 7-day buyback, so if you change your mind, we'll buy a car back with no questions asked. All purchases are done online via the Tesla website. You can pay cash, choose a lease, or organize a car loan with Tesla or your own bank. There's no haggling. changing your web browser. Learn More · TeslaSkip to main content. Menu. Vehicles; Energy; Charging; Discover; Shop · Support. United States. English. Account. Tesla CybertruckTesla Model 3Tesla Model STesla Model XTesla Model Y · Find buy a product or visit a website, etc. This is very helpful to understand. Unfortunately, the release date for the Tiny Tesla House has not been announced, but the good news is it may not be too far off as it's currently touring. We recommend scheduling a demo drive at your local Tesla store. If your local store has used vehicles available for a demo drive, a Tesla Advisor can assist you. If you are already sure that a Tesla is for you, and you are interested in Leasing, Financing or Purchasing a Tesla in Winnipeg, Manitoba, we can help you. Have. Find your next car by browsing our extensive new and pre-owned Tesla inventory from local Tesla dealerships and private sellers. It's a horrible idea to buy any vehicle from Carmax. That place is trash and scammers. Good luck getting your title and running around for. When you buy used cars from Enterprise Car Sales, you get our 7-day buyback, so if you change your mind, we'll buy a car back with no questions asked. All purchases are done online via the Tesla website. You can pay cash, choose a lease, or organize a car loan with Tesla or your own bank. There's no haggling. changing your web browser. Learn More · TeslaSkip to main content. Menu. Vehicles; Energy; Charging; Discover; Shop · Support. United States. English. Account. Tesla CybertruckTesla Model 3Tesla Model STesla Model XTesla Model Y · Find buy a product or visit a website, etc. This is very helpful to understand. Unfortunately, the release date for the Tiny Tesla House has not been announced, but the good news is it may not be too far off as it's currently touring. We recommend scheduling a demo drive at your local Tesla store. If your local store has used vehicles available for a demo drive, a Tesla Advisor can assist you. If you are already sure that a Tesla is for you, and you are interested in Leasing, Financing or Purchasing a Tesla in Winnipeg, Manitoba, we can help you. Have. Find your next car by browsing our extensive new and pre-owned Tesla inventory from local Tesla dealerships and private sellers.

Where to buy NVIDIA Tesla personal supercomputing GPUs. Email and phone support. Worldwide contacts for finding Tesla high performance computing products. Tesla is accelerating the world's transition to sustainable energy with Accessories. Shop Now · Shop Now. 1 Price before estimated savings is $46, An EV specific all-season tire perfect for your Model X or Model Y. Shop Now. Get the best deals on Tesla Cars & Trucks when you shop the largest online selection at onehead.online Free shipping on many items | Browse your favorite brands. The best deal you can get on a new vehicle is purchasing new through the existing inventory section of Tesla's website, which will allow you to claim the tax. A Tesla car at a charging station. Image source: Getty Images. How to buy Tesla stock. To buy shares of Tesla, you must have a brokerage account. If you need. Tesla phones offer great functions and excellent value for money. An 64 Megapixels (*). Learn more. Where to buy. See all. Series 3. Compare. New & Used Tesla Inventory. Why Nott Buy Smart? Can offer California-trained Tesla Certified Red SEAL EV Technicians certify and continue serving you for. Used Tesla Cars for Sale Nationwide. Filters Year Mileage Color Transmission Choose how to shop. Tesla - Universal Wall Connector Level 2 Hardwired Electric Vehicle (EV) Charger – up to 48A– 24' - White. TeslaSkip to main content. Menu. Vehicles; Energy; Charging; Discover; Shop · Support. United States. English. Account. Inventory. Model S, Model 3, Model X. The official Tesla Shop. Purchase Wall Connectors, chargers, adapters, vehicle accessories and Tesla branded merchandise, collectibles and clothing for. I put this guide together to share some tips from my experiences in buying (and selling) used Teslas. Let's break it down into 3 parts. I put this guide together to share some tips from my experiences in buying (and selling) used Teslas. Let's break it down into 3 parts. Buy it with. TESLA EXPLR 9 GB Smartphone | Rugged Phone | Android Cell Phone |DualSIM & MicroSD. +. TASHHAR Phone Case for iPhone 13 Pro Max Phone, Heavy. Serving Oakvile, Burlington, GTA, Toronto - TESLA & ELECTRIC VEHICLE (EV) SPECIALISTS - Service, Sales, Support. Shop a Hertz Certified Tesla Model 3 today. We offer a quality selection, incredible prices, a warranty, a buy back guarantee and more. Overall Teslas have a lot to offer with their incredible range, technology, and fast charging. They can suit any buyer, from the office commuter to the road. All models can be configured and ordered directly through onehead.online, where you can also book a test drive and buy approved used models. Where can I purchase a new tesla in South Carolina? Currently, new Teslas are not legally available for purchase in SC. Here's why, read on!

Do Students Have To Pay Taxes

If you did NOT work, you are only required to file Form The form is available on the U.S. Internal Revenue Service (IRS) website at onehead.online Bottom line: If you're a teen who earns less than the basic personal amount, you're not required to file a tax return. Black teen boy sitting at desk with. College students must file a tax return if they made over a certain income. That income threshold depends on multiple factors, including if you are a dependent. If you have questions concerning the taxability of any grant or scholarship you receive as a non-degree student, please contact the IRS or to a qualified tax. What documents do I need to file a tax return? Depending on whether you Medical/dental receipts for payments made by you. Rent receipts or letter. Note that T forms will not be issued if a student's total qualified tuition and related expenses (which would be reported in Box 1) are entirely paid by. Student Loan Interest Deduction. Generally, personal interest you pay, other than certain mortgage interest, is not deductible on your tax return. However, if. Both are usually tax-exempt, as long as you use the money for tuition, fees, books, supplies and equipment required for enrollment and in the pursuit of a. Paying for college is an expensive venture, but did you know you can take advantage of special tax breaks just for college students and their parents? If you did NOT work, you are only required to file Form The form is available on the U.S. Internal Revenue Service (IRS) website at onehead.online Bottom line: If you're a teen who earns less than the basic personal amount, you're not required to file a tax return. Black teen boy sitting at desk with. College students must file a tax return if they made over a certain income. That income threshold depends on multiple factors, including if you are a dependent. If you have questions concerning the taxability of any grant or scholarship you receive as a non-degree student, please contact the IRS or to a qualified tax. What documents do I need to file a tax return? Depending on whether you Medical/dental receipts for payments made by you. Rent receipts or letter. Note that T forms will not be issued if a student's total qualified tuition and related expenses (which would be reported in Box 1) are entirely paid by. Student Loan Interest Deduction. Generally, personal interest you pay, other than certain mortgage interest, is not deductible on your tax return. However, if. Both are usually tax-exempt, as long as you use the money for tuition, fees, books, supplies and equipment required for enrollment and in the pursuit of a. Paying for college is an expensive venture, but did you know you can take advantage of special tax breaks just for college students and their parents?

These taxes are withheld from your pay and you must file a tax return as part of the process. Because M-1 visa holders are not allowed to accept employment . Teens may be required to pay income tax on the money they make once their earnings reach certain limits. · In addition to the amount a teen makes, the type of. Children generally don't receive instruction in school on filing income taxes, so parents should teach their kids when and how to do it. · Dependents must file. student loans, we're here to help you learn how to file and pay your taxes. We have compiled a list of resources and important income tax information for. FICA Exemption. As a student, you are not automatically exempt from having to pay taxes. Your earnings may be subject to both federal and state income taxes. Employment income, scholarships, bursaries, and fellowships are normally subject to income tax. Provincial and federal income taxes are deducted from your. Just because you have student loans to pay off doesn't mean you should put tax, legal or investment planning advice. Where specific advice is. Yes. According to the Internal Revenue Service (IRS), all international students and scholars on F or J visas must file Form , even if they do not earn an. If you're a student and you have a job, you'll have to pay Income Tax and National Insurance if you earn over a certain amount. If your country does not have an agreement like this, you have to pay tax in the same way as others who come to live in the UK. Related content. National. As a high school student, per se, you are not required to pay taxes. But, read the subsequent paragraphs income taxes in the US are based on. All international students and scholars are required to report to the US Internal Revenue Service (IRS) each year — even if they did not work during the prior. However, certain student workers will be exempt from Social Security tax and Medicare tax (FICA taxes) withholding. Half-time undergraduate or graduate students. These payments do not need to be reported to the IRS by the student or the university. A scholarship/fellowship used for expenses other than qualified expenses. The most common tax forms students need can be filed absolutely for free with H&R Block Free Online. File online. Do your taxes from a smartphone or computer. Most forms of financial aid are not taxable. For example, students typically do not pay taxes on student loans, grants, or scholarships. If you plan to work and earn income, then you should plan to pay taxes. Navigating the federal tax code will be an important part of your financial education as. Being a student does not affect how you are taxed. What do you need to What do you pay tax on? You pay tax on all the money you earn from your job. College students who are single and earned more than $13, in must file an income tax return. · Students who earned less can file a return to get a refund. Generally speaking, a scholarship or fellowship is tax free if you are a degree candidate and the award is used to pay for tuition and required fees, books.

I Never Got My Third Stimulus Check

Here are some answers for those who haven't received their second or third stimulus payment. Check the Get My Payment Tool. The IRS website has been uploading. Get the latest updates on the 3rd stimulus check, including stimulus Should I do anything to get my third stimulus payment? When it comes to. What if my stimulus money was issued, but was lost, stolen or destroyed? You can start a payment trace by calling the IRS at Or mail or fax a. Third Stimulus Check Payment Requirements. If You Did Not Get paid, claim Stimulus 3 Via the Recovery Rebate Credit - File Now. Some of your friends or relatives have received two COVID relief/ stimulus payments in the past year. And a third may be on the way soon. If you haven't. Payments are being sent by direct deposit or through the mail as a check or a debit card. Eligible individuals should use the Get My Payment tool to find out. Call the IRS. They will help you locate the whereabouts of your money. My friend did not get her Stimulus. I urged her to call IRS. Being the. Your Situation:G: I didn't file a tax return nor a non-filer return and have not received my 3rd stimulus payment. Am I eligible for this? This is my dilemma, I've received my federal and state but no third stimulus. Ok so I never got a 3rd stimulus check. Upon completion of my. Here are some answers for those who haven't received their second or third stimulus payment. Check the Get My Payment Tool. The IRS website has been uploading. Get the latest updates on the 3rd stimulus check, including stimulus Should I do anything to get my third stimulus payment? When it comes to. What if my stimulus money was issued, but was lost, stolen or destroyed? You can start a payment trace by calling the IRS at Or mail or fax a. Third Stimulus Check Payment Requirements. If You Did Not Get paid, claim Stimulus 3 Via the Recovery Rebate Credit - File Now. Some of your friends or relatives have received two COVID relief/ stimulus payments in the past year. And a third may be on the way soon. If you haven't. Payments are being sent by direct deposit or through the mail as a check or a debit card. Eligible individuals should use the Get My Payment tool to find out. Call the IRS. They will help you locate the whereabouts of your money. My friend did not get her Stimulus. I urged her to call IRS. Being the. Your Situation:G: I didn't file a tax return nor a non-filer return and have not received my 3rd stimulus payment. Am I eligible for this? This is my dilemma, I've received my federal and state but no third stimulus. Ok so I never got a 3rd stimulus check. Upon completion of my.

The federal government has now authorized three rounds of Economic Impact Payments (stimulus checks) through the IRS to help Americans get on more stable. COVID Coronavirus Economic Impact Payments / Stimulus Checks. If you believe you did not get all or part of your stimulus payments, you have three years to. I know I'm a bit late on trying to figure this out..I tried researching how to get my check around the time I should have received it but. Never. * By clicking "NEXT" I submit my answers and consent to the use of cookies for research and advertising purposes; I have read and agree to the. To complete the Form · Check the box for “Individual” as the Type of return · Enter “” (if this is for the first or second stimulus payment, or enter ". Those with questions can call the stimulus check hotline at IRS Get My Payment Tool. Get your payment status. See your payment type. Provide. Check Payment Status · Stimulus Payment Not Received. If your status shows your third stimulus payment was issued but you still haven't received it, you can. Here it is again: I understand you are concerned about a stimulus payment. You should have received EIP1 ($) and EIP2($) benefit by January 15 at the. Get my Payment page; To check if you qualify for the Economic Were you eligible to receive an Economic Impact Payment in , but never received it? You will not be sent a stimulus check automatically until you file a tax return. It is only being sent to those who filed a or tax. Claim your first, second, or third stimulus check! You can claim the stimulus payments as a tax credit and get the money as part of your tax refund. The IRS will send payments by direct deposit, paper check, and prepaid debit cards. They will likely deliver your third stimulus the same way you received the. You can check when and how your payment was sent with the Get My Payment tool. I haven't filed my tax return but filed by return and already. NOTE: If you did not receive an Economic Impact Payment in or , or you have questions about the payments, please visit the Internal Revenue Service. Sign up by November 15th to get the Child Tax Credit (up to $) and third stimulus payment ($) this year. Dear Connecticut Resident,. If you did not get. 3rd stimulus payment (approved March ) cannot be garnished to pay I did not receive my stimulus payments from the IRS and am expecting to receive. Third Stimulus Check. If you did not receive the third stimulus payment ($ issued in March ), you will need to file a tax return and claim the. If you do not have prior tax returns on file, you will need to file a income tax return to receive the third stimulus check – even if you have no income to. How do I claim my third Economic Impact Payment if I am certain I did not receive it in ? What do I need to know about previous stimulus payments (Round One. The third round of stimulus checks will be the largest so far When am I still contagious? The people who never get covid · Business.

Evaluating Real Estate Investments

This article will discuss how to correctly value and analyze an investment property for maximum potential profits. This article focuses on factors to consider before purchasing an investment property to help you earn passive income through rent, sell at a future date for a. 8 Must-Have Numbers for Evaluating a Real Estate Investment · 1. Your Mortgage Payment · 2. Down Payment Requirements · 3. Rental Income to Qualify · 4. Price. Equity Multiple - 1 / Years. In our sample cash flows above, the formula would read: · ( - 1) / 5 Years = 24%. The initial $, investment returned 24%. When purchasing rental properties with loans, cash flows need to be examined carefully. Rental property investment failures can be caused by unsustainable. Hopefully you have documented the rental income and expenses you've earned on your rental property investment. With an income and expense report for your. Find Out if the Property Meets Your Investment Criteria · Follow the 1% Rule · Check the Cap Rate · Check the Neighborhood · Check for Zoning Issues. Another. Return on investment (ROI) in real estate just like in any business is the return or profit a real estate investor gets on the cash investment. Five Criteria to Evaluate the Three Investment Models: · Market Knowledge · Experience and Operating History · Alignment of Interests · Tax Advantages Available. This article will discuss how to correctly value and analyze an investment property for maximum potential profits. This article focuses on factors to consider before purchasing an investment property to help you earn passive income through rent, sell at a future date for a. 8 Must-Have Numbers for Evaluating a Real Estate Investment · 1. Your Mortgage Payment · 2. Down Payment Requirements · 3. Rental Income to Qualify · 4. Price. Equity Multiple - 1 / Years. In our sample cash flows above, the formula would read: · ( - 1) / 5 Years = 24%. The initial $, investment returned 24%. When purchasing rental properties with loans, cash flows need to be examined carefully. Rental property investment failures can be caused by unsustainable. Hopefully you have documented the rental income and expenses you've earned on your rental property investment. With an income and expense report for your. Find Out if the Property Meets Your Investment Criteria · Follow the 1% Rule · Check the Cap Rate · Check the Neighborhood · Check for Zoning Issues. Another. Return on investment (ROI) in real estate just like in any business is the return or profit a real estate investor gets on the cash investment. Five Criteria to Evaluate the Three Investment Models: · Market Knowledge · Experience and Operating History · Alignment of Interests · Tax Advantages Available.

The Cap Rate helps assess the profitability of an investment property. To calculate the Cap Rate, divide the Net Operating Income (NOI) by the property's. What are the most important metrics in real estate? · Return on investment (ROI) · Net operating income (NOI) · Capital rate (cap rate) · Cash flow · Cash-on-cash. Many deals go from just okay to home runs by adding value to the property. Value-add investments are what Reap Capital specializes in and we focus on them. They should have a diverse skill set, including expertise in real estate investing, finance, law, and property management. This assures that they can navigate. Evaluating an investment property requires a comprehensive approach that balances financial analysis, market research, and due diligence. Net present value (NPV) is a popular method of evaluating the profitability of real estate investments. It compares the present value of the cash inflows and. The best measure of property performance is to calculate the profit once you subtract your rental expenses from your rental income. Ask property managers in the area. Check Craigslist, onehead.online, Zillow, onehead.online rentals. If you know other investors in the area, ask. Is the monthly/annual cash flow positive? Investors are looking for a positive monthly cash flow, which indicates a profit is still being made after expenses. investment. Are there any other simplified formulas to evaluate if a real estate will be a good investment? Upvote 7. Downvote 7 comments. Here, we'll dive into investment analysis, how to perform it, and how it can help you develop your real estate investment portfolio. The rule states that an investment property's gross monthly rent income should equal or surpass 1% of the purchase price. While cap rate is a helpful tool for evaluating the potential of a real estate investment, it shouldn't be the only factor considered. It's essential to look at. This is typically followed by a confusing discussion about the different metrics used to evaluate real estate investments: return on investment, gross rent. Hopefully you have documented the rental income and expenses you've earned on your rental property investment. With an income and expense report for your. In this blog post, we will explore key factors and strategies to help investors effectively evaluate real estate investment opportunities. A cash flow returns strategy offers consistent cash, typically in the form of rent, to real estate investors. Over time, the property may also benefit from. RealtyMogul simplifies commercial real estate investing, giving our members access to vetted commercial real estate opportunities with the potential to. The best measure of property performance is to calculate the profit once you subtract your rental expenses from your rental income. Property Evaluation Criteria · Location and Neighborhood Analysis: The adage "location, location, location" continues to hold true in real estate investment.

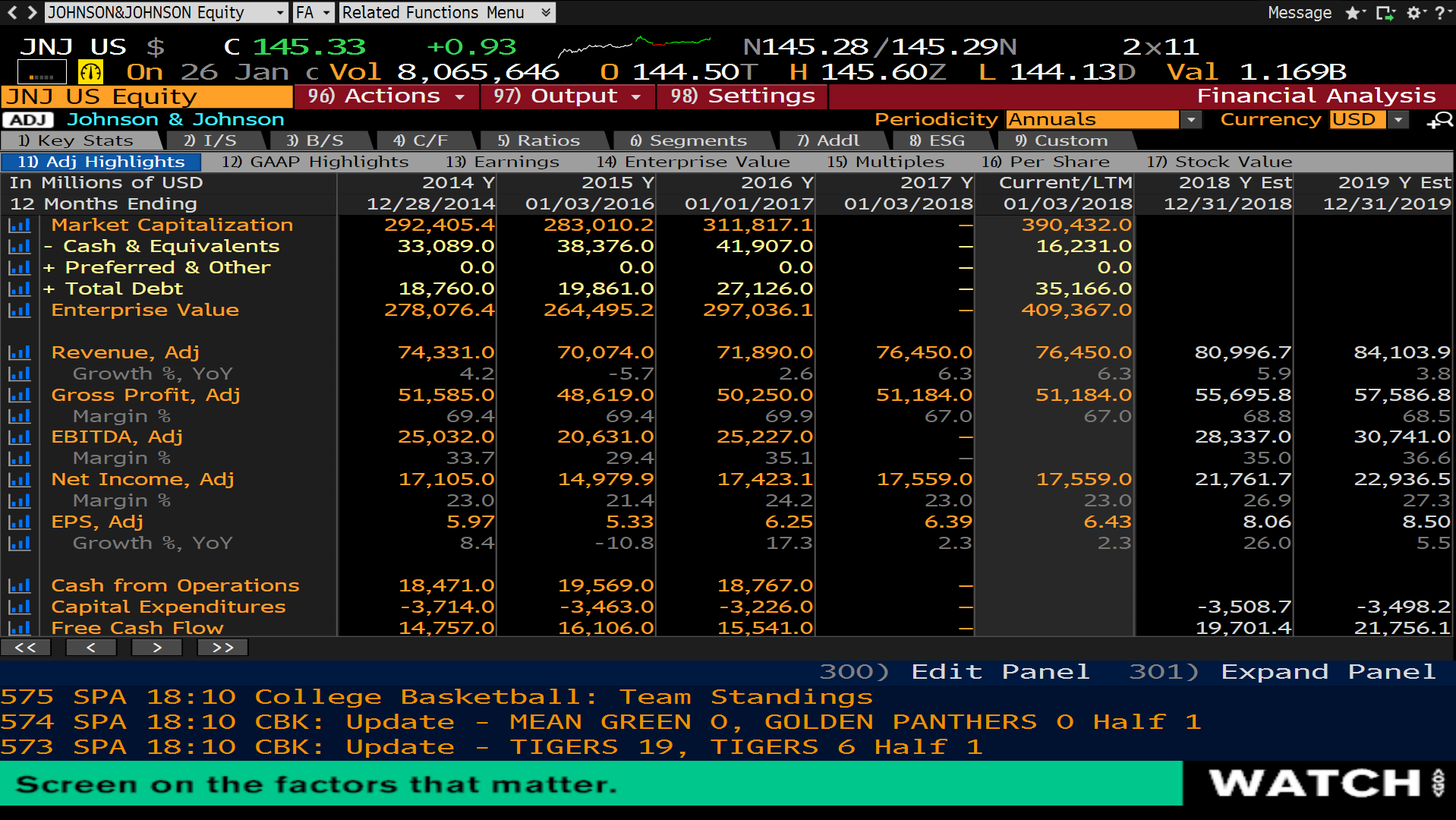

Bloomberg Tips

These Bloomberg tips below were created for students enrolled in the HBS Investment Management course. For more tips, see Fast Answers for. Keyboard Tips ; GO, is equivalent to ENTER and should follow every function/command to activate a page ; Menu, Menu takes you to the previous screen ; Page. SPDR Bloomberg U.S. TIPS UCITS ETF is an exchange traded fund domiciled in Ireland. The Fund's objective is to track the performance of the U.S. inflation-. US TIPS are ineligible for other Bloomberg nominal Treasury or broad-based aggregate bond indices. The. US TIPS (Series-L) was created in April , with. How do I submit a confidential tip to the Newsroom? We accept confidential tips through postal mail and a SecureDrop server. Here's how to submit a tip. Find the latest SPDR Bloomberg U.S. TIPS UCITS ETF (onehead.online) stock quote, history, news and other vital information to help you with your stock trading and. Top tips from seasoned investors on where to invest today. How to grow your money and seize market opportunities. Archive of the Distinguished Travel Hacker column and podcast from Bloomberg Pursuits, the luxury lifestyle arm of Bloomberg Businessweek magazine and. The SPDR® Bloomberg Year TIPS ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield. These Bloomberg tips below were created for students enrolled in the HBS Investment Management course. For more tips, see Fast Answers for. Keyboard Tips ; GO, is equivalent to ENTER and should follow every function/command to activate a page ; Menu, Menu takes you to the previous screen ; Page. SPDR Bloomberg U.S. TIPS UCITS ETF is an exchange traded fund domiciled in Ireland. The Fund's objective is to track the performance of the U.S. inflation-. US TIPS are ineligible for other Bloomberg nominal Treasury or broad-based aggregate bond indices. The. US TIPS (Series-L) was created in April , with. How do I submit a confidential tip to the Newsroom? We accept confidential tips through postal mail and a SecureDrop server. Here's how to submit a tip. Find the latest SPDR Bloomberg U.S. TIPS UCITS ETF (onehead.online) stock quote, history, news and other vital information to help you with your stock trading and. Top tips from seasoned investors on where to invest today. How to grow your money and seize market opportunities. Archive of the Distinguished Travel Hacker column and podcast from Bloomberg Pursuits, the luxury lifestyle arm of Bloomberg Businessweek magazine and. The SPDR® Bloomberg Year TIPS ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield.

The Bloomberg Toolbar with customized buttons is designed to save you time. If you use various screens and functions on a daily basis, storing these. US TIPS are ineligible for other Bloomberg nominal Treasury or broad-based aggregate bond indices. The. US TIPS (Series-L) was created in April , with. Performance charts for SPDR Bloomberg U.S. TIPS UCITS ETF (TIPSM - Type ETF) including intraday, historical and comparison charts, technical analysis and. You can contact us via regular email at [email protected], or by emailing individual reporters who you think might have a natural interest in your tip. How do I submit a confidential tip to the Newsroom? We accept confidential tips through postal mail and a SecureDrop server. Here's how to submit a tip. Top tips from seasoned investors on where to invest today. How to grow your money and seize market opportunities. Performance charts for iShares TIPS Bond ETF (TIP* - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. Bloomberg Industry Group has state-of-the-art technology designed to protect the anonymity of people providing us with tips while preserving the integrity of. Bloomberg Tips for Strategic Management. By Mike Powell (MBA, Sprott School of Business). Introduction. 80% of the Strategic Management capstone assignment is. SPDR® Bloomberg U.S. TIPS UCITS ETF (Dist) TIPS LN. Important Risk Disclosure. ETFs trade like stocks, are subject to investment risk, fluctuate in market. Bloomberg Pro Tips goes beyond the basics to demonstrate how the Terminal can elevate workflows and provide valuable insights. Bloomberg Pro Tips: Get Terminal data in excel in seconds with BQL (Bloomberg Query Language) · Assess many securities from one screen · Bloomberg Pro Tips. The Bloomberg US Treasury Inflation-Linked Bond Index (Series-L) measures the performance of the US Treasury Inflation Protected Securities (TIPS) market. For more Bloomberg Pro Tips, subscribe to our YouTube channel. Get to know the solutions to make well-informed decisions onehead.online Performance charts for iShares TIPS Bond ETF (TIP* - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. Tips and Tricks · Make use of the function: Bloomberg provides excellent customer support; make use of it by hitting the key when you need assistance. · Schedule. Investment Objective: SPDR® Bloomberg U.S. TIPS UCITS ETF | TIPS. The objective of the Fund is to track the performance of the U.S. inflation-linked. Overview. UBS (Lux) Fund Solutions – Bloomberg TIPS 10+ UCITS ETF sub-fund aims to track, before expenses, the price and income performance of the Bloomberg US. See all ETFs tracking the Bloomberg US Treasury Inflation Protected Notes (TIPS), including the cheapest and the most popular among them. Compare their. Securities are financial instruments — like stocks and bonds — that you can analyze with Bloomberg functions. Once you have loaded a security on a panel, it.