onehead.online

Learn

Will My Insurance Go Up For Speeding Ticket

Do Speeding Tickets Affect Insurance Premiums? In most cases, the answer is yes. If you are issued a ticket for speeding, you can expect your insurance premium. If the accident is your fault your insurance company will have to pay out to fix the other party's car and that means your rates will increase come renewal time. How much will my insurance rates go up after a speeding ticket? On average, car insurance typically goes up about 25% after a speeding ticket For example. However, if you have multiple speeding tickets or a combination of tickets and accidents, you may experience a substantial increase in your insurance premium. GEICO's Policy · First-time Offense Leniency: Some drivers with excellent records might not see an immediate rate increase after their first. How will a speeding ticket affect my insurance? How much your auto insurance premiums will increase, if at all, after you receive a speeding ticket depends on. The answer is likely yes, speeding tickets may increase the amount you pay for car insurance. Speeding tickets are considered part of your driving record. Will a parking ticket make my premium go up? Parking tickets aren't moving violations, so they typically don't affect your insurance, especially since they. Minor offenses like parking tickets usually don't impact your insurance rates, but moving violations like speeding, DUIs, or reckless driving. Do Speeding Tickets Affect Insurance Premiums? In most cases, the answer is yes. If you are issued a ticket for speeding, you can expect your insurance premium. If the accident is your fault your insurance company will have to pay out to fix the other party's car and that means your rates will increase come renewal time. How much will my insurance rates go up after a speeding ticket? On average, car insurance typically goes up about 25% after a speeding ticket For example. However, if you have multiple speeding tickets or a combination of tickets and accidents, you may experience a substantial increase in your insurance premium. GEICO's Policy · First-time Offense Leniency: Some drivers with excellent records might not see an immediate rate increase after their first. How will a speeding ticket affect my insurance? How much your auto insurance premiums will increase, if at all, after you receive a speeding ticket depends on. The answer is likely yes, speeding tickets may increase the amount you pay for car insurance. Speeding tickets are considered part of your driving record. Will a parking ticket make my premium go up? Parking tickets aren't moving violations, so they typically don't affect your insurance, especially since they. Minor offenses like parking tickets usually don't impact your insurance rates, but moving violations like speeding, DUIs, or reckless driving.

And they can impose higher car insurance premiums because of that. Experts say that a single ticket can leave you with a rate hike of anywhere between 7 and 28%. Minor offenses, such as a single speeding ticket, may lead to a small increase in your premiums. However, multiple tickets or serious violations, like DUI . Yes, speeding tickets can indeed affect your insurance rates, but the extent of the impact varies greatly. Several factors determine how much a ticket will. The Texas Department of Insurance puts it succinctly, saying, “Insurance companies will charge you more if you've had accidents or gotten tickets.” That's. The short answer is: It depends. Though a speeding ticket could raise your auto insurance rate, your rate may not be affected at all. Traffic violations: Certain traffic violations, such as speeding, running a red light or stop sign, and reckless driving, may also increase your insurance rates. There's a $ annual premium increase attached to a ticket for breaking the speed limit by 16 to 20 miles per hour. USAA again offers the smallest premium. The number of speeding tickets you have on your record will affect the price increase. The first ticket may not result in a huge increase, but if you have. A speeding ticket affects your auto insurance rates for three to five years, the amount of time most tickets remain on your motor vehicle report. Fact, traffic tickets have costly fines, but they can also cause insurance rate increases. Drivers with current traffic tickets on their record, or accidents. Yes, a ticket will almost definitely raise your car insurance rate in Texas. But that's only true if you don't do anything about it. NerdWallet found that car insurance typically increases about 25% after a speeding ticket. onehead.online notes that if you are miles over the speed limit. Speeding tickets at least 30 mph over the speed limit - This speeding ticket can increase your car insurance rates by 30% on average. Not wearing a seatbelt -. Speeding tickets for faster speeds that appear on your driving record will raise your insurance premium costs more than convictions for lower speeds. Speeding. Just like speeding ticket amounts vary from state to state, the amount your car insurance premium may increase will vary depending on your driving record. Your insurance rates will go up if you're always getting speeding tickets. This shows them that you're at risk for accidents. A speeding ticket will increase your car insurance rates by an average of 39%. · Not all car insurance companies rate a speeding ticket the same way, so shopping. If you get a speeding ticket from a police officer and are convicted, your car insurance rate may go up. If you get too many major traffic convictions, your car. Going between 1 and 14 miles per hour over the speed limit will statistically increase your insurance rate by 11 percent. Your driving record, however, is fully in your control. California traffic tickets and “at fault” accidents can cause auto insurance increases. Other factors in.

A 1031 Exchange

Section allows deferral of the gain. However, upon a subsequent sale of property, the capital gain is deferred will be recognized unless another exchange. there shall be no nonrecognition of gain or loss under this section to the taxpayer with respect to such exchange; except that any gain or loss recognized by. Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal Revenue Code Section This paper is a basic overview of IRC section tax deferred exchanges. It is not intended to be a guide to such an exchange, as it may omit rules and. An IRC Section Exchange (“Exchange”) is a tax benefit that allows investors to defer the capital gains tax normally due on the sale of investment real. A exchange works by allowing you to exchange the tax liability from selling one investment property for the commitment to reinvest in another property of. What is a Exchange? An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or. In order to accomplish a exchange, an investor must enter into an exchange agreement with the intermediary, and the intermediary must hold the proceeds. Exchanges are part of the Federal Tax Code, and Florida recognizes Exchanges for real estate transactions. Florida follows all federal Exchange. Section allows deferral of the gain. However, upon a subsequent sale of property, the capital gain is deferred will be recognized unless another exchange. there shall be no nonrecognition of gain or loss under this section to the taxpayer with respect to such exchange; except that any gain or loss recognized by. Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal Revenue Code Section This paper is a basic overview of IRC section tax deferred exchanges. It is not intended to be a guide to such an exchange, as it may omit rules and. An IRC Section Exchange (“Exchange”) is a tax benefit that allows investors to defer the capital gains tax normally due on the sale of investment real. A exchange works by allowing you to exchange the tax liability from selling one investment property for the commitment to reinvest in another property of. What is a Exchange? An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or. In order to accomplish a exchange, an investor must enter into an exchange agreement with the intermediary, and the intermediary must hold the proceeds. Exchanges are part of the Federal Tax Code, and Florida recognizes Exchanges for real estate transactions. Florida follows all federal Exchange.

Exchange Properties as an Inheritance. Upon the death of the original seller, any deferred capital gains taxes from exchanges are erased. The. Exchange Equal or Up in Value. To defer all taxable gain, a property owner must first reinvest all the equity in the relinquished property into the replacement. Most Exchange transactions will be structured as Forward or Delayed Exchanges where you sell and close on the sale of your relinquished property. The exchange permits an investor to defer tax payment by following a series of strict rules. What follows is a list of what you need to know. A exchange allows you to defer capital gains tax, thus freeing more capital for investment in the replacement property. A exchange is reserved for property held for productive use in a trade or business or for investment. A exchange is a strategy, according to Realty Mogul, used by real estate investors to defer capital gains income taxes (or income tax losses). The most common Exchange structure is a Forward, or Delayed, Exchange where you sell your relinquished property first and then acquire your. An exchange is the sale of a business use or investment property followed by the acquisition of another linked together by paperwork and completed within the. This guide will provide you an overview of the Exchange process, the benefits of a Exchange and common questions people ask when New York investors. The person conducting the exchange has 45 days to identify their potential replacement properties. In total, one has days to acquire the replacement. The exchange permits an investor to defer tax payment by following a series of strict rules. What follows is a list of what you need to know. A section Tax Deferred Exchange is an investment and tax deferral strategy that should be considered by every seller of non-owner occupied property. To qualify for a exchange, both relinquished and replacement properties need to be held for use in a trade or business or for investment. exchanges allow real estate investors to defer paying capital gains tax when the proceeds from real estate sold are used to buy replacement real estate. A exchange is very straightforward. If a business owner has property they currently own, they can sell that property, and if they reinvest the proceeds. Marcus & Millichap, the market leader in exchanges, offering expert guidance and the industry's largest inventory of exclusive listings. The good news is that the regulations do permit investors to add cash from outside of their exchange to accomplish desired objectives such as buying more. Nearly all real property is like-kind to each other. There is a two-pronged test for properties to qualify for IRC § tax-deferral treatment. This comprehensive guide aims to help you make informed decisions in optimizing your real estate portfolio and reaping the benefits of tax-deferred

Open Up Brokerage Account

The Schwab One brokerage account has no minimum balance requirements, no minimum balance charges, no minimum trade requirements, and there is no requirement to. A WellsTrade account offered by Wells Fargo Advisors opened online comes with Brokerage Cash Services, which give you convenient money-movement options. A brokerage account is an investment account that allows you to buy and sell a variety of investments. Compare and learn how to open a brokerage account. My uncle who runs a small financial counselor business could start setting me up with a brokerage account, but I am unsure if I should put any thought into. You can open a trading account and a demat account by providing your individual details like pan card, residence proof along with your photo. If. A brokerage account, sometimes referred to as a securities account, is a type of investment account that a person can open with a brokerage firm. Steps to open an account · 1. Choose the type of investment account you want · 2. Compare fees, pricing schedules, and minimum balance requirements · 3. Review. A brokerage account is an essential tool for investors, providing access to a wide range of investment opportunities, including stocks, bonds, mutual funds and. How to open up a brokerage account · 1. Answer a few questions · 2. Submit the online application · 3. Fund your account · 4. Research investments. The Schwab One brokerage account has no minimum balance requirements, no minimum balance charges, no minimum trade requirements, and there is no requirement to. A WellsTrade account offered by Wells Fargo Advisors opened online comes with Brokerage Cash Services, which give you convenient money-movement options. A brokerage account is an investment account that allows you to buy and sell a variety of investments. Compare and learn how to open a brokerage account. My uncle who runs a small financial counselor business could start setting me up with a brokerage account, but I am unsure if I should put any thought into. You can open a trading account and a demat account by providing your individual details like pan card, residence proof along with your photo. If. A brokerage account, sometimes referred to as a securities account, is a type of investment account that a person can open with a brokerage firm. Steps to open an account · 1. Choose the type of investment account you want · 2. Compare fees, pricing schedules, and minimum balance requirements · 3. Review. A brokerage account is an essential tool for investors, providing access to a wide range of investment opportunities, including stocks, bonds, mutual funds and. How to open up a brokerage account · 1. Answer a few questions · 2. Submit the online application · 3. Fund your account · 4. Research investments.

Opening a new account online can take around 15 minutes. Typically, you'll fill out an online form providing information on your employment, net worth. There is no minimum to open a Self-Directed brokerage account. However, accounts that remain unfunded for more than 30 days or have a balance below $ for a. Open an online brokerage account. Trade stocks and ETFs with Stash. Start with $5. Open a brokerage account. To begin investing on Stash, you must be approved. You can also open your account by selecting. Open Account Now from the Action Center on the. My Accounts page after you sign in. As part of the account opening. The E*TRADE brokerage account offers a mix of investment choices, as well as research, guidance, information, trading tools, and on-call financial. There are a few simple steps to opening a brokerage account. We'll dive deep into each one below 1. Choose a brokerage provider. 2. Sign up for an account 3. Opening an investment account online is simple, secure and only takes minutes. Help me get started. I want to understand my options. Show me all accounts. Open a brokerage account with JP Morgan Wealth Management. Access thousands of investments including stocks, ETFs, mutual funds and options. 1. Assess Your Financial Goals and Risk Tolerance · 2. Consider Costs and Value · 3. Preparing to Set up Your Account · 4. Funding Your New Brokerage Account. To open a brokerage account, you'll need to connect with one of our financial advisors who can walk you through the process, including signing an Account. This multi-feature trading and investing account allows you to select from a broad range of investment choices, including stocks, bonds, ETFs, options, and. Brokerage accounts allow investors to buy and sell numerous types of investments. When opening a brokerage account, investors have two main options. A brokerage account is a trading or investment tool you'll use when you want to buy and sell securities in the financial markets. If you are looking to open a brokerage account and find stocks and shares to invest in, make sure you are using a real stockbroker and not a CFD provider. Open an account. Fortunately, setting up a brokerage account is the easiest part of the whole process. Once you've decided on a brokerage firm, the online. An online brokerage account allows you to easily transfer available funds between your Bank of America bank and Merrill investment accounts. How to choose the right broker for you · Decide what kind of brokerage account you want to open · Identify your investing goals · Know the types of investments you. You may also be able to fund your account with a debit card. Keep in mind that some brokerage accounts and/or investments have minimum investment requirements. You can open a brokerage account by yourself from the comfort of your own home. Many firms let you open an account online by completing a simple application. Be. If you have disposable income remaining after paying your expenses each month, you can start slowly contributing your savings into a brokerage account. It's.

What Does Uvxy Track

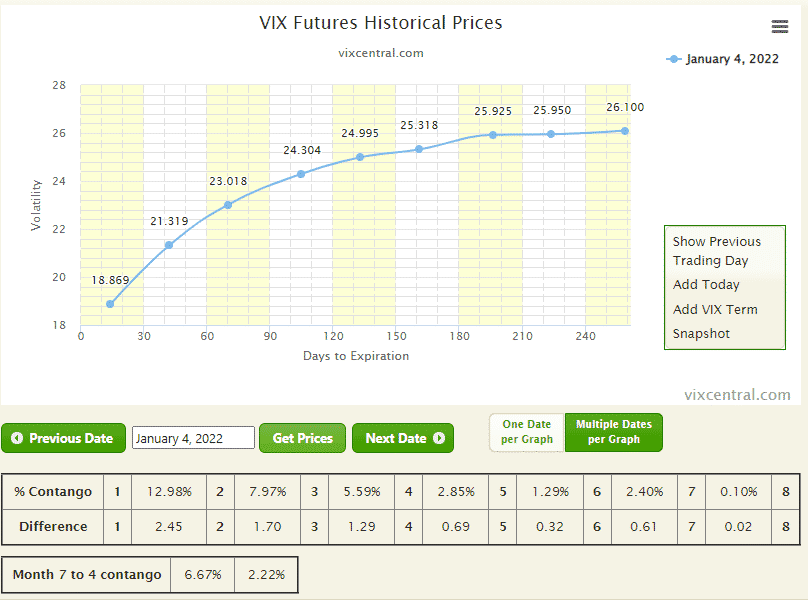

Given the specific focus of UVXY and SVXY on volatility, they do not directly correlate with traditional sectors or industries. Their holdings consist of VIX. Get a technical analysis of ProShares Ultra VIX Short-Term Futures ETF (UVXY) with the latest MACD of and RSI of Stay up-to-date on market. VXX directly tracks month 1 and month 2 futures. UVXY does the same thing except x ProShares Trust II - ProShares Ultra VIX Short-Term Futures ETF is an exchange traded fund launched by ProShare Capital Management LLC. It is track x the. The index seeks to offer exposure to market volatility through publicly traded futures markets and is UVXY ProShares Ultra VIX Short-Term Futures ETF. Performance data quoted represents past performance and does not indicate future results. Investment returns will fluctuate and are subject to market volatility. Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Market. UVXY, an ETF, has an underlying portfolio of VIX futures contracts, while TVIX is an exchange-traded note (ETN) that tracks an index of VIX futures. This. The VIX, also known as the “fear index,” is a widely followed indicator of equity market volatility. Because the VIX tends to spike when stock markets struggle. Given the specific focus of UVXY and SVXY on volatility, they do not directly correlate with traditional sectors or industries. Their holdings consist of VIX. Get a technical analysis of ProShares Ultra VIX Short-Term Futures ETF (UVXY) with the latest MACD of and RSI of Stay up-to-date on market. VXX directly tracks month 1 and month 2 futures. UVXY does the same thing except x ProShares Trust II - ProShares Ultra VIX Short-Term Futures ETF is an exchange traded fund launched by ProShare Capital Management LLC. It is track x the. The index seeks to offer exposure to market volatility through publicly traded futures markets and is UVXY ProShares Ultra VIX Short-Term Futures ETF. Performance data quoted represents past performance and does not indicate future results. Investment returns will fluctuate and are subject to market volatility. Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Market. UVXY, an ETF, has an underlying portfolio of VIX futures contracts, while TVIX is an exchange-traded note (ETN) that tracks an index of VIX futures. This. The VIX, also known as the “fear index,” is a widely followed indicator of equity market volatility. Because the VIX tends to spike when stock markets struggle.

The ETF UVXY is a leveraged fund that keeps track of the short-term volatility and is a commodities pool that provides exposure to the short-term VIX futures. The UVXY stock price today is What Stock Exchange Is UVXY Traded On? UVXY is listed and trades on the NYSE stock exchange. Is UVXY a Good ETF to Buy? The ProShares Ultra VIX Short-Term Futures ETF (USD) is a(n) Equity Exchange Traded Funds (ETF) seeks to invest in Volatility sector located in USA. UVXY, also known as ProShares Trust Ultra VIX Short Term Futures ETF, is a company in the EMPTY sector. ProShares Trust Ultra's website is EMPTY. Market. The index seeks to offer exposure to market volatility through publicly traded futures markets and is designed to measure the implied volatility of the S&P VIXY exposure is similar to other unleveraged long VIX ETFs/ETNs like VXX (iPath/Barclays). It is designed to track the performance of S&P VIX Short-Term. Explore the latest technical analysis report for ProShares Ultra VIX Short-Term Futures ETF (UVXY), focusing on trend, momentum, volatility. How Does UVXY Work? Exchange Trade Fund UVXY is a X leveraged fund that tracks short-term volatility. To have a good understanding of UVXY (full name. The VIX Futures Indexes track the performance of VIX futures contracts; they do not track the performance of the VIX, and the Matching Funds should not be. ProShares Ultra VIX Short-Term Futures ETF ETF holdings by MarketWatch. View complete UVXY exchange traded fund holdings for better informed ETF trading. It tracks VIX futures. When the VIX goes up, people can bet on what the VIX will be several months from now. UVXY/VXX/VIXY/TVIX track the. ProShares is the world's largest provider of ETFs benchmarked to VIX futures indexes. · The funds do not track the performance of the Cboe Volatility Index (VIX). It invests in volatile stocks of large-cap companies. The fund seeks to track x the daily performance of the S&P VIX Short-Term Futures Index. ProShares. ProShares Ultra VIX Short-Term Futures is a n/a business based in the US. ProShares Ultra VIX Short-Term Futures shares (UVXY) are listed on the BATS and. It invests in volatile stocks of large-cap companies. The fund seeks to track x the daily performance of the S&P VIX Short-Term Futures Index. ProShares. Performance data quoted represents past performance and does not indicate future results. Investment returns will fluctuate and are subject to market volatility. UVXY provides x leveraged exposure to an index comprising first- and second-month VIX futures positions with a weighted average maturity of one month. The index seeks to offer exposure to market volatility through publicly traded futures markets and is designed to measure the return from a rolling long. Once account is opened, you can add funds in U.S. dollars to buy ProShares Ultra VIX Short-Term Futures ETF (UVXY). Indirect investment: One can invest. UVXY / ProShares Trust II - ProShares Ultra VIX Short-Term Futures ETF off-exchange short sale volume is shown in the following chart. Short Sale volume shows.

Granite Creek Copper Stock

Granite Creek Copper Ltd stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Granite Creek Copper Ltd. ; Market Value, €M ; Shares Outstanding, M ; EPS (TTM), € ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Find the latest Granite Creek Copper Ltd. (GCXXF) stock quote, history, news and other vital information to help you with your stock trading and investing. According to Granite Creek Copper Ltd.'s latest financial reports and current stock price. The company's current ROE is %. This represents a change of. Granite Creek Copper Ltd. (GCXXF) Real-Time. Shareholders: Granite Creek Copper Ltd. ; Michael Rowley. %. 2,,, %, 76 $ ; John Cumming. %. ,, %, 11 $. Granite Creek Copper Ltd. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range - 52 Wk Range - Learn the comprehensive overview for Granite Creek Copper Ltd. GCXXF. Get the latest stock price for Granite Creek Copper Ltd. (GCX), plus the latest news, recent trades, charting, insider activity, and analyst ratings. Granite Creek Copper Ltd stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Granite Creek Copper Ltd. ; Market Value, €M ; Shares Outstanding, M ; EPS (TTM), € ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Find the latest Granite Creek Copper Ltd. (GCXXF) stock quote, history, news and other vital information to help you with your stock trading and investing. According to Granite Creek Copper Ltd.'s latest financial reports and current stock price. The company's current ROE is %. This represents a change of. Granite Creek Copper Ltd. (GCXXF) Real-Time. Shareholders: Granite Creek Copper Ltd. ; Michael Rowley. %. 2,,, %, 76 $ ; John Cumming. %. ,, %, 11 $. Granite Creek Copper Ltd. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range - 52 Wk Range - Learn the comprehensive overview for Granite Creek Copper Ltd. GCXXF. Get the latest stock price for Granite Creek Copper Ltd. (GCX), plus the latest news, recent trades, charting, insider activity, and analyst ratings.

Granite Creek Copper Ltd. Stock ; Sector. Diversified Mining ; Calendar. - Q4 Earnings Release (Projected) ; Mean consensus. BUY ; Number of. Research Granite Creek Copper's (TSXV:GCX) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance. Granite Creek Copper completes a private placement offering, raising $ million through the issuance of million units at $ per unit. The offering. Get the latest Granite Creek Copper Ltd (GRK) real-time quote, historical performance, charts, and other financial information to help you make more. GCX | Complete Granite Creek Copper Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Granite Creek Copper Ltd (GCX). TSXV. Currency in CAD. Disclaimer. Read on to see how this company's stock is doing as the market for copper heats up. Tags: Critical Metals · Copper Mining Co. Moves Forward With Acquisition. What Is the Granite Creek Copper Ltd Stock Price Today? The Granite Creek Copper Ltd stock price today is What Is the Stock Symbol for Granite Creek. Complete Granite Creek Copper Ltd. stock information by Barron's. View real-time GCXXF stock price and news, along with industry-best analysis. View the latest Granite Creek Copper Ltd. (GCXXF) stock price, news, historical charts, analyst ratings and financial information from WSJ. Key Stats · Market CapM · Shares OutM · 10 Day Average Volume13, · Dividend- · Dividend Yield- · Beta- · YTD % Change Granite Creek Copper Ltd is a Vancouver-based, public exploration company. It is in the business of acquiring and carrying out exploration on mineral. Granite Creek Copper Stock Snapshot ; M · Number of Shares ; Dividend in CAD ; Dividend Yield ; Free Float in % ; EPS in CAD. What is Granite Creek Copper Ltd(TSXV:GCX)'s stock price today? The current price of TSXV:GCX is C$ The 52 week high of TSXV:GCX is C$ and 52 week low. Recent News · August 19, Granite Creek Copper Launches Drill Campaign at Carmacks Copper-Gold-Silver Project in Yukon, Canada · May 28, Granite. Granite Creek Copper Intercepts Meters of % Copper Equivalent Including Meters of % CuEq at the Carmacks VANCOUVER, BC /. GCXXF | Complete Granite Creek Copper Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. As of May the stock price of Granite Creek Copper is $ What is the current market cap of Granite Creek Copper? The current market capitalization of. Kodiak Copper Corp. $ KDKCF ; Coppernico Metals Inc. $ COPR ; Kutcho Copper Corp. $ KCCFF ; Bitterroot Resources Ltd. $ BITTF ; Stillwater. A high-level overview of Granite Creek Copper Ltd. (GCXXF) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals.

Best Free Air Miles Credit Card

Best flat-rate airline card: Capital One Venture Rewards Credit Card. Capital One Venture Rewards Credit Card offers a competitive, flat reward rewards rate on. Earn MileagePlus® award miles through our great selection of United credit card products from Chase. FREE CHECKED BAG. UnitedSM Explorer Card. 50, Best Flexible Rewards Card for Airlines. Chase Sapphire Preferred® Card · ; Best Premium Travel Rewards Card. Capital One Venture X Rewards Credit Card · 2X Miles at Restaurants and on Delta Purchases · Created with Sketch. No Foreign Transaction Fees · Created with Sketch. 20% Back on In-Flight Purchases. If you prioritize points over miles, you'll likely be better served by a general travel credit card than an airline mileage rewards card. General travel cards. Get a FREE 5GB Eskimo e-SIM (worth S$) from the MoneySmart Eskimo e-SIM Giveaway! No min. spend required! Valid until - See more details below. Airline credit cards ; Capital One Venture Rewards Credit Card · 69 reviews · 2x - 5x · $ Welcome bonus. 75, Miles. Editors' bonus estimate. up to $1, Discover the benefits of BMO AIR MILES credit cards and earn AIR MILES Reward Miles on every purchase, while enjoying exclusive perks. Top-pick airline credit cards. Top for multiple air miles schemes. Amex Rewards: 10, bonus, no fee; Amex Gold: 20, bonus, £/yr fee from year two. Top. Best flat-rate airline card: Capital One Venture Rewards Credit Card. Capital One Venture Rewards Credit Card offers a competitive, flat reward rewards rate on. Earn MileagePlus® award miles through our great selection of United credit card products from Chase. FREE CHECKED BAG. UnitedSM Explorer Card. 50, Best Flexible Rewards Card for Airlines. Chase Sapphire Preferred® Card · ; Best Premium Travel Rewards Card. Capital One Venture X Rewards Credit Card · 2X Miles at Restaurants and on Delta Purchases · Created with Sketch. No Foreign Transaction Fees · Created with Sketch. 20% Back on In-Flight Purchases. If you prioritize points over miles, you'll likely be better served by a general travel credit card than an airline mileage rewards card. General travel cards. Get a FREE 5GB Eskimo e-SIM (worth S$) from the MoneySmart Eskimo e-SIM Giveaway! No min. spend required! Valid until - See more details below. Airline credit cards ; Capital One Venture Rewards Credit Card · 69 reviews · 2x - 5x · $ Welcome bonus. 75, Miles. Editors' bonus estimate. up to $1, Discover the benefits of BMO AIR MILES credit cards and earn AIR MILES Reward Miles on every purchase, while enjoying exclusive perks. Top-pick airline credit cards. Top for multiple air miles schemes. Amex Rewards: 10, bonus, no fee; Amex Gold: 20, bonus, £/yr fee from year two. Top.

Credit Card Offers · Aeroplan® Credit Card · American Airlines Credit Union Visa® Signature credit · Arvest Visa Signature® Credit Card · Bank of America® Premium. However, if you don't fancy paying for an annual fee, both the free versions of the Barclaycard Avios and British Airways are a good bet. The British Airways. Miles chasers that are new to the game should apply for the Citibank Rewards Card which has the best sign up promotion for free air miles as it allows new. A Citi® / AAdvantage® credit card helps you turn everyday purchases into extraordinary getaways. Start earning miles and Loyalty Points today. The Chase trifecta, Amex trifecta, and Capital One duo are generally the best travel setups. But they take a bit of time and research to optimize rewards. The Discover it Miles travel credit card earns unlimited rewards with no annual fee. See if the travel credit card from Discover is best suited for you. The Capital One Venture X Rewards Credit Card is a premium travel rewards card that earns 5X miles on flights and vacation rentals booked through Capital One. Earn 40, Bonus Miles after you spend $2, in eligible purchases on your new Card in your first 6 months of Card Membership. Enjoy a $0 introductory Annual. Best Miles Credit Cards in Singapore · Citi PremierMiles Card · Citi Prestige Card · DBS Altitude Visa Signature Card · HSBC TravelOne Credit Card · Standard. In other words, for every pound you spend, you'll earn air miles that equate to money off or free flights. How to choose the best air miles credit card for. The best airline credit card with no annual fee is the United Gateway℠ Card because it offers 2 miles per $1 spent with United, gas stations, local transit. Our best airline credit card picks · Winner. Delta SkyMiles Reserve American Express Card · Best for beginners. Capital One Venture Rewards Credit Card · Best for. Capital One Venture Rewards Credit Card · Enjoy $ to use on Capital One Travel in your first cardholder year, plus earn 75, bonus miles once you spend. What are the best air miles credit cards? - September ; American Express Nectar Credit Card. £30 (no fee for first year), 20, nectar points (£2, The Capital One Venture X Rewards Credit Card offers luxury travel benefits with a range of airline and hotel transfer partners. Capital One Miles can be. An air miles credit card is a type of rewards card. It lets you earn air miles when you spend money on it. Air miles can be exchanged for plane tickets and. Avios offers a range of benefits through air miles credit cards, making it easier for travelers to earn and redeem points for various rewards. By using an Avios. Military Airline Credit Cards · Chase Aeroplan Credit Card Military | Annual Fee Waived · Best Airline Credit Card | American, Delta, Southwest, United · AMEX. There's only one credit card that takes you places with your preferred airline: Delta SkyMiles Credit Cards from American Express. 12 partner offers · The Platinum Card from American Express · Capital One VentureOne Rewards for Good Credit · Delta SkyMiles Reserve American Express Card · Citi /.

How Will Rising Interest Rates Affect Housing Market

When interest rates are lower, demand for houses tends to go up, and when demand goes up (but supply doesn't go up likewise), prices go up. But. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until Increased consumer leverage and rapidly rising interest rates could be the catalyst that pushes the housing market, and possibly the economy, into a slower. If interest rates stay flat and as they can't really go any lower you would get a moderate decline in prices as the market works through the price increase from. Prospective home buyers in the real estate market are also adversely affected when interest rates rise. NAHB's priced-out estimates show that, depending on the. All things being equal, a rise in demand for any product will cause the price to rise. During periods of low interest rates, lenders for. When the economy is strong, interest rates tend to rise along with growth. · Rising rates make homes more expensive for buyers, thereby reducing the demand for. Rising interest rates have an undeniable effect on housing prices, a concept applicable to the housing market across the globe, including cities like Los. The cost of buying investment properties will increase as mortgage rates go up. Housing loan rate increases can benefit parties who own dwellings for rental. When interest rates are lower, demand for houses tends to go up, and when demand goes up (but supply doesn't go up likewise), prices go up. But. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until Increased consumer leverage and rapidly rising interest rates could be the catalyst that pushes the housing market, and possibly the economy, into a slower. If interest rates stay flat and as they can't really go any lower you would get a moderate decline in prices as the market works through the price increase from. Prospective home buyers in the real estate market are also adversely affected when interest rates rise. NAHB's priced-out estimates show that, depending on the. All things being equal, a rise in demand for any product will cause the price to rise. During periods of low interest rates, lenders for. When the economy is strong, interest rates tend to rise along with growth. · Rising rates make homes more expensive for buyers, thereby reducing the demand for. Rising interest rates have an undeniable effect on housing prices, a concept applicable to the housing market across the globe, including cities like Los. The cost of buying investment properties will increase as mortgage rates go up. Housing loan rate increases can benefit parties who own dwellings for rental.

Although inventories of homes for sale are up slightly, the sellers' market still has some life, even as interest rates rise. But conditions vary from one. Interest rates have a powerful effect on the value of real estate, as they can ultimately influence an individual's ability to purchase residential properties. If you already own your home, an increase in inflation might also make it more costly to refinance your mortgage. For those with fixed-rate mortgages, rising. If interest rates stay flat and as they can't really go any lower you would get a moderate decline in prices as the market works through the price increase from. A decades long regime of high interest rates supports lower house prices, as long as nothing else breaks in the housing market. Today you have a. With interest rates forecast to rise to per cent, we explore what the short- and long-term implications are for mortgage holders. On the other hand, higher interest rates across the whole economy can lower real estate prices. Indeed, we are seeing prices start to fall in some cities today. To get inflation back to the benchmark rate of 2%, the Federal Reserve has done four interest rate hikes in alone. Higher interest rates reduce buyer. Higher interest rates typically have two effects on the housing market that can help drive down prices: They price some buyers out of the market, which is good. Housing Market Is Still Going Strong and Driving Interest Rate Increases Despite rising mortgage rates, the housing market remains strong. Mortgage. Simply put, when the interest rate is low, it is good news for property buyers – credit is cheaper and mortgage rates are decreased. A hike in the rates has the. With rising interest rates and a slowed transaction market, the commercial real estate sector faces increased risk of economic distress. · Refinancing property. House prices are going up and down Rising interest rates are affecting Real Estate in in several ways. Limited supply and steady demand are helping keep. You may have heard that interest rates and home prices have an inverse relationship, meaning that when one goes up, the other goes down, but this is not. Inflation is the arch enemy of long-term debt, including mortgages, because inflation effectively lowers what your currency is worth. For example, if you owe. With interest rates on the rise, now is a good time to look at how the housing market could be affected. Historically, rising interest rates result in a. Market competition and affordability: While rising rates may eventually lead to sellers lowering prices, the current housing market doesn't have enough. Many homebuyers flock to variable-rate mortgages because they offer the lowest interest rates you can find on the market. But they come with added risks. No one. “Higher rates mean higher monthly mortgage payments, which result in less buying power for home shoppers. Prospective homebuyers today will not be able to. onehead.online: year fixed-rate mortgages will average between % and % through September “Mortgage rates have moved lower in recent weeks amid growing.

How Do I Buy Treasuries

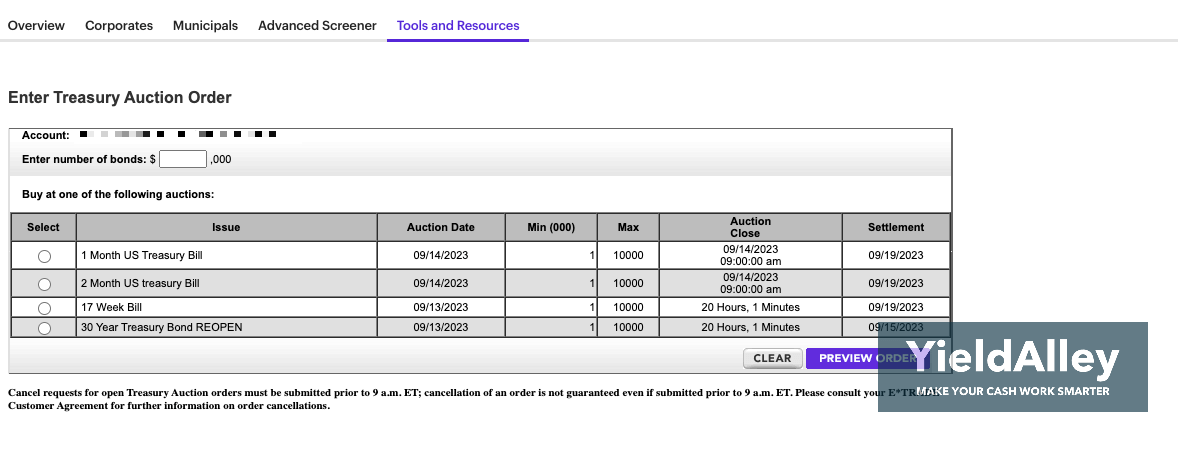

onehead.online website · Log on to your TreasuryDirect account · Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and. U.S. Treasuries. Direct debt obligations backed by the full faith and credit We offer two ways to buy bonds through our platform. For more details. Treasury Bonds. We sell Treasury Bonds for a term of either 20 or 30 years. Bonds pay a fixed rate of interest every six months until they mature. If you area regular retail customer you can buy Treasury Bonds (and bills, notes, and other Treasury issues) direct from the US government. TreasuryDirect is an electronic marketplace and online account system where investors can buy, hold, and redeem eligible book-entry Treasury securities. They are low-risk, interest-bearing securities that individual investors can purchase directly from the government on TreasuryDirect. Savings bonds are designed. Investors can buy T-bills in electronic form from a brokerage firm, which could cost a small fee, or directly from TreasuryDirect, the platform of the U.S. How to trade T-Bills, Bonds, or Notes. You will need to contact the tastytrade trade desk to purchase bills, bonds, or notes. If you have the CUSIP please be. Investors considering Treasury securities have opportunities to buy bonds both at regularly scheduled auctions (see Auction Schedule) and in the secondary. onehead.online website · Log on to your TreasuryDirect account · Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and. U.S. Treasuries. Direct debt obligations backed by the full faith and credit We offer two ways to buy bonds through our platform. For more details. Treasury Bonds. We sell Treasury Bonds for a term of either 20 or 30 years. Bonds pay a fixed rate of interest every six months until they mature. If you area regular retail customer you can buy Treasury Bonds (and bills, notes, and other Treasury issues) direct from the US government. TreasuryDirect is an electronic marketplace and online account system where investors can buy, hold, and redeem eligible book-entry Treasury securities. They are low-risk, interest-bearing securities that individual investors can purchase directly from the government on TreasuryDirect. Savings bonds are designed. Investors can buy T-bills in electronic form from a brokerage firm, which could cost a small fee, or directly from TreasuryDirect, the platform of the U.S. How to trade T-Bills, Bonds, or Notes. You will need to contact the tastytrade trade desk to purchase bills, bonds, or notes. If you have the CUSIP please be. Investors considering Treasury securities have opportunities to buy bonds both at regularly scheduled auctions (see Auction Schedule) and in the secondary.

Futu provides us treasury bonds of different maturities. Learn how to buy us treasury bonds in Hong Kong, how to purchase US year Treasury bonds and. Get to know the different types of bonds. Treasury bonds. Treasuries are issued through the U.S. Department of the Treasury. Go to your TreasuryDirect account. · Choose the Buy Direct tab. · Follow the prompts to choose the security you want, specify the amount you want to buy, and fill. onehead.online is the one and only place to electronically buy and redeem US Savings Bonds. We also offer electronic sales and auctions of other US-backed. Discover how to research and buy Treasuries in just a few simple steps. Discover how to research and buy Treasuries in just a few simple steps. Individuals and investors can purchase Dutch government bonds through their bank, investment adviser or broker. Dutch government bonds are traded on the. Move your savings into a Treasury Account with onehead.online and invest in US T-bills that pay a higher yield than traditional and high-yield savings accounts. The primary market is an auction on the TreasuryDirect site to purchase the bills directly from the government. Bidders can include individual investors, banks. The way you buy and sell bonds on the primary market often depends on the type of bond you select. Treasury bonds can be bought in denominations of $ Investors buy STRIPS at a price below the face value of the securities and then receive the full amount when the STRIPS mature. Treasury Inflation-Protected. You'll receive an email from TreasuryDirect confirming your purchase and providing a transaction summary. Your payment will typically be settled the next day. The best way to buy Treasury bonds is through TreasuryDirect, a broker or a bank. Before you purchase T-bonds through TreasuryDirect, you will need to set up an. 3. Secondary market Investors can buy or sell Treasury Bills on the secondary market from market makers, such as Retail and Investment Banks. These. To Trade U.S. Treasuries like T-Bills in TWS, you can: Add the symbol “US-T” to your Watchlist or Order Entry window to open the Treasury Bond Selector and. The minimum requirement for buying a Treasury is usually $, and while the typical lot size is $, or $1 million, investors can purchase less than that. Before you can buy or sell treasury bills and treasury bonds on the Fidelity Mobile App, you will need to be registered with the Central Securities Depository . Using a retirement account to invest in T-Bills is a tax-advantageous way to gain access to a safe investment with solid returns. However, in order to invest in. We know you can buy Treasuries at any bank, but at Edward Jones you won't just be sent on your merry way with a deposit receipt and a bond certificate. We. Supplement your knowledge with product-focused industry research and articles; Find out more about bond funds. To purchase Investor Guides in digital format as.

How Much Is A Downpayment

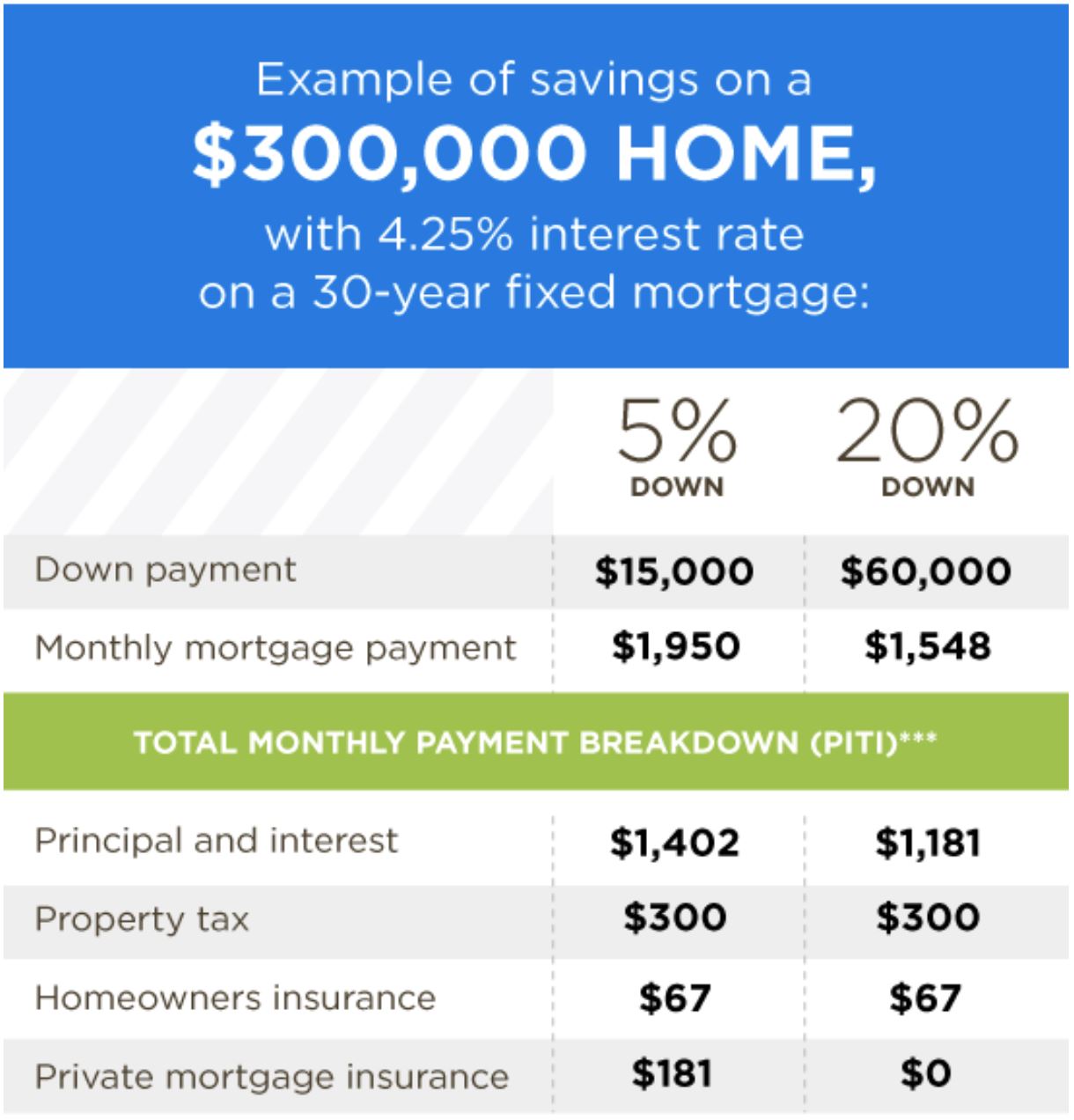

In other words, the purchase price of a house should equal the total amount of the mortgage loan and the down payment. Often, a down payment for a home is. So how much of a down payment should you save up for a car with bad credit? Ideally, 10% plus whatever you can afford on top of that. One of the best ways to. That depends on the purchase price of your home and your loan program. Different loan programs require different percentages, usually ranging from 5% to 20%. We recommend putting at least 10% down on a home, but 20% down is the gold standard. That may seem a bit daunting, especially for first-time homebuyers. There. That depends on the purchase price of your home and your loan program. Different loan programs require different percentages, usually ranging from 5% to 20%. When buying a house, a down payment is the first payment made. It's a percentage of the total cost that comes from your own funds. A mortgage loan usually. The required down payment is usually determined by the type of mortgage you choose, your financial situation and the type of property you're buying (a primary. Our down payment calculator helps you figure out how much money you'd need to save to qualify for a mortgage loan. Less cash on hand: Making a larger down payment often means you'll have less money available to make repairs or meet other financial goals, like building an. In other words, the purchase price of a house should equal the total amount of the mortgage loan and the down payment. Often, a down payment for a home is. So how much of a down payment should you save up for a car with bad credit? Ideally, 10% plus whatever you can afford on top of that. One of the best ways to. That depends on the purchase price of your home and your loan program. Different loan programs require different percentages, usually ranging from 5% to 20%. We recommend putting at least 10% down on a home, but 20% down is the gold standard. That may seem a bit daunting, especially for first-time homebuyers. There. That depends on the purchase price of your home and your loan program. Different loan programs require different percentages, usually ranging from 5% to 20%. When buying a house, a down payment is the first payment made. It's a percentage of the total cost that comes from your own funds. A mortgage loan usually. The required down payment is usually determined by the type of mortgage you choose, your financial situation and the type of property you're buying (a primary. Our down payment calculator helps you figure out how much money you'd need to save to qualify for a mortgage loan. Less cash on hand: Making a larger down payment often means you'll have less money available to make repairs or meet other financial goals, like building an.

Generally, making a down payment of 20% or more can help you avoid having to buy private mortgage insurance. Down payments commonly range from 3% to 20% of the purchase price. Understanding a Down Payment. The size of your down payment depends on your savings, income. How much should I put down for a new home? Your browser does not support frames. Please upgrade to a modern browser to use all the functionality of this. A down payment is what you pay upfront and out of pocket for a home. Your down payment offsets how much money you need to borrow for a mortgage, which. Often, a down payment for a home is expressed as a percentage of the purchase price. As an example, for a $, home, a down payment of % is $8,, while. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying. The down payment requirement is equal to a percentage of the cost of the property and can vary based on the type of loan you receive. For example, if a home. Contrary to popular belief, most mortgages do not require the traditional 20% of the purchase price as a down payment. Let's break down how. Buyers putting down less than 20% are required to pay Private Mortgage Insurance (PMI) monthly until they build up 20% equity in their home. Contrary to popular belief, most mortgages do not require the traditional 20% of the purchase price as a down payment. Let's break down how. A down payment is the money you pay at closing toward the cost of your new home; it's the difference between your mortgage amount and your purchase price. Typical rule of thumb is: you can afford a house that's up to 3 times your yearly income before taxes, and you should put 20% down plus a few. Specifically, you can get Federal Housing Administration loans with a % down payment. Lenders also offer conventional loan programs with 3% down, including. What is the minimum down payment in BC? For homes with a purchase price of $, or less, the minimum down payment remains at 5%. The homes between. Down Payment Calculator · % Down Payment (FHA) · 5% Down Payment (Conforming) · 20% Down Payment. Mortgage options for low down payments Here are some common types of loans that offer low-down-payment options. First time homebuyers might qualify for a. Our down payment calculator helps estimate your mortgage based on how much money you use as a down payment on a house. Learn how much you should put down. In the market for real estate? Use our down payment calculator to find out how much more you need to save for your down payment. How much do you need for a down payment? Generally, buyers are encouraged to pay 20% of the property's price as down payment. If you're buying a house for. Nevertheless, a 20% down payment remains the standard for mortgages and is generally preferable to most lower alternatives offered by B-lenders, such as Credit.

Best High End Dress Shirts

Men's Designer Dress Shirts ; TOM FORD. Men's Cotton Check Slim Fit Dress Shirt. $ ; Eton. Men's Textured Solid Slim-Fit Dress Shirt. $ ; Theory. Men's. The HUGO BOSS collection of high end men's shirts includes classic button-ups and casual workwear designs. Shop now in the HUGO BOSS Online Store! Made with wrinkle resistant, moisture wicking, high stretch, and machine washable performance fabric, there's simply no better dress shirt. Perfectly tailored high Performance Dress Shirts that are comfortable, stretchy, wrinkle resistant, moisture wicking & machine washable. Men's dress shirts that redefine sophistication. Explore Todd Snyder's collection of stylish and refined options to elevate your office and formal attire. Men's Dress Shirt Regular Fit Non Iron Solid. Tommy Hilfiger · (1,) ; Men's Regular Fit Non Iron Herringbone Solid, White, / Calvin Klein · (97). Providing high-quality dress shirts in poplin, twill and Oxford cloth, Tyrwhitt's range is vast and eclectic. Robert Talbott's men's dress shirts feature our signature Monterey semi-spread collar, which make them look great with or without a necktie. High-end brands: Brooks Brothers: A historic American brand known for its classic, tailored dress shirts made with high-quality materials. Men's Designer Dress Shirts ; TOM FORD. Men's Cotton Check Slim Fit Dress Shirt. $ ; Eton. Men's Textured Solid Slim-Fit Dress Shirt. $ ; Theory. Men's. The HUGO BOSS collection of high end men's shirts includes classic button-ups and casual workwear designs. Shop now in the HUGO BOSS Online Store! Made with wrinkle resistant, moisture wicking, high stretch, and machine washable performance fabric, there's simply no better dress shirt. Perfectly tailored high Performance Dress Shirts that are comfortable, stretchy, wrinkle resistant, moisture wicking & machine washable. Men's dress shirts that redefine sophistication. Explore Todd Snyder's collection of stylish and refined options to elevate your office and formal attire. Men's Dress Shirt Regular Fit Non Iron Solid. Tommy Hilfiger · (1,) ; Men's Regular Fit Non Iron Herringbone Solid, White, / Calvin Klein · (97). Providing high-quality dress shirts in poplin, twill and Oxford cloth, Tyrwhitt's range is vast and eclectic. Robert Talbott's men's dress shirts feature our signature Monterey semi-spread collar, which make them look great with or without a necktie. High-end brands: Brooks Brothers: A historic American brand known for its classic, tailored dress shirts made with high-quality materials.

Our dress shirts are exquisitely crafted from the finest materials, which have been perfected with a unique silk touch finish. Eton shirts are woven in Italy using only the finest materials, in a broad range of styles. Explore our curated selection of fabrics: signature twill, crisp. Performance Dress Shirts for Men. Wrinkle-resistant long sleeve performance dress shirts. New styles & original best sellers now made from recycled polyester. Shop men's luxury shirts at John Varvatos. Discover our collection of men's casual shirts & dress shirts with free US shipping over $ Twillory dress shirts are made with performance fabric. They are moisture wicking with 4-way stretch. But wait it gets better - you don't even have to iron them. Getting the perfect fit. To look your best for any occasion, there are several factors to take into account when choosing the finest men's dress shirts: · Shirt. Dress Shirts - Button Down Dress Shirts - Short Sleeve Polo's Automatic Leather Belts Leather Belts Neck Ties 3pc Neck Tie Sets Handkerchiefs Socks Shoes. Shop our collection of men's luxury dress shirts at BrooksBrothers. Discover a range of sophisticated styles and impeccable craftsmanship, perfect for any. We understand as much as we desire a functional dress shirt, style matters. Our performance long-sleeve button down shirts lack nothing in the style department. Dependable, bombproof, durable, high-performance, stain-repellent, machine washable, moisture-wicking. Shirts · Best Sellers; More links. Search. Search. Designer Dress Shirts at Saks: Discover new arrivals from today's top brands. July in Texas has me actually succumbing to the marketing power of the bro-startup companies that are hawking sweat-wicking dress shirts. Charles Tyrwhitt luxury shirts are made from the highest quality fabrics for an unrivalled smooth, soft feel: two-ply s and s yarns and Egyptian cotton. Charles Tyrwhitt luxury shirts are made from the highest quality fabrics for an unrivalled smooth, soft feel: two-ply s and s yarns and Egyptian cotton. Robert Talbott's men's dress shirts feature our signature Monterey semi-spread collar, which make them look great with or without a necktie. Our dress shirts are exquisitely crafted from the finest materials, which have been perfected with a unique silk touch finish. Shop men's dress shirts at Lands' End. FREE shipping available. Find quality dress shirts for men, men's dress clothes, formal wear for men, and more. Our men's designer shirts collection has everything from dress shirts to casual shirts, and polos in an assortment of colors and patterns at Top Shelf. July in Texas has me actually succumbing to the marketing power of the bro-startup companies that are hawking sweat-wicking dress shirts. We also offer hand-sewn dress shirts made in Italy using the finest Italian fabircs. Wilkes & Riley have the best dress shirts for men online or stop in at.